In the intricate world of finance, the interest rate curve is a dynamic indicator that reflects the pulse of economic health. Shaped by the interplay of monetary and fiscal policies, this curve has the power to signal impending economic shifts.

Let’s explore scenarios where it steepens, flattens, or even inverts based on the stances of monetary and fiscal policies.

Understanding the Interest Rate Curve

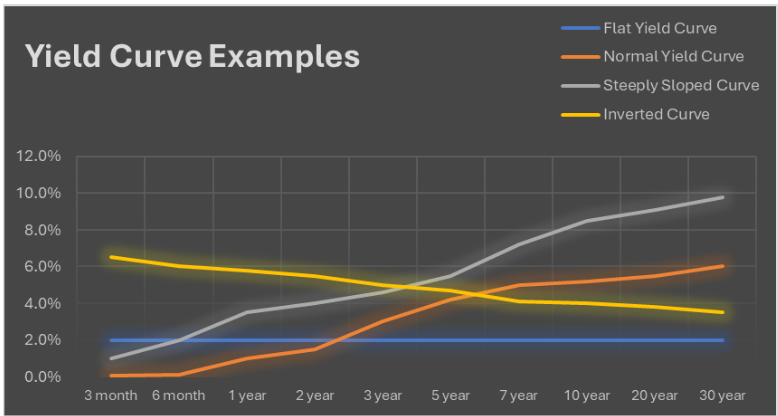

Before delving into the influence of policies, let’s grasp the basics. The interest rate curve depicts the relationship between interest rates and time. Typically, it slopes upward due to the inherent risk associated with lending over a more extended period. This natural curve sets the stage for understanding how policy decisions can alter its trajectory.

Steepening the Curve

Picture a scenario where both monetary and fiscal policies are expansionary – a cocktail of lowered interest rates and increased government spending. This potent mix fuels economic growth, prompting businesses and consumers to borrow more. As demand for loans rises, so does the interest rates for long-term borrowing, causing the curve to steepen.

Insight: The steepened curve signals optimism in the economy, indicating expectations of higher future inflation and robust economic activity.

Flattening the Curve

A combination of expansionary monetary policy (lower short-term rates) coupled with a restrictive fiscal policy (reduced government spending) can lead to a flattened interest rate curve. In this scenario, short-term rates drop, while long-term rates remain relatively stable. The government’s belt-tightening counteracts the monetary stimulus, resulting in a more balanced curve.

Insight: A flattened curve may suggest caution – while monetary policy fosters short-term growth, fiscal restraint tempers expectations for the long haul.

Inverting the Curve

An inverted interest rate curve, where short-term rates surpass long-term rates, is the harbinger of economic unease. This phenomenon often occurs when monetary policy takes a restrictive turn, pushing short-term rates higher, while fiscal policy remains expansionary, bolstering long-term rates. The result is a curve that inverts, setting off alarm bells for potential economic downturns.

Insight: Historically, an inverted yield curve has been a reliable predictor of recessions, making it a crucial signal for investors and policymakers alike.

Converging Monetary and Fiscal Policies

When both monetary and fiscal policies adopt a restrictive stance, the interest rate curve may find a middle ground – neither steep nor flat. This scenario arises when central banks raise short-term rates to curb inflation while governments cut spending to rein in economic exuberance.

Read: A Historical Analysis Of Interest Rate Raise And Cuts

Insight: A balanced curve reflects a delicate equilibrium, where policymakers aim to keep inflation in check without stifling economic growth entirely.

Summary

Understanding yield curve empowers investors, policymakers, and the general public to interpret the signals of economic health. Whether steepening, flattening, or inverting, the interest rate curve is a canvas painted by the strokes of policy decisions.