The DINK (Dual Income, No Kids) lifestyle has gained popularity in recent years, challenging traditional notions of family and parenting. From a financial standpoint, embracing the DINK lifestyle entails unique considerations and opportunities. This article explores the financial implications of choosing to be DINK, examining various aspects such as savings, investments, and retirement planning.

Financial Freedom through Dual Incomes

One of the primary advantages of the DINK lifestyle is the potential for greater financial freedom. With two incomes and no children to support, DINK couples often have higher disposable incomes. This surplus can be allocated towards various financial goals, including saving for emergencies, investing for the future, and enjoying a higher standard of living.

Savings and Investments

DINK couples have the opportunity to prioritise savings and investments, laying a solid foundation for long-term financial security. Without the financial responsibilities associated with raising children, they can allocate a larger portion of their income towards building wealth. This may involve contributing to retirement accounts, as well as investing in stocks, bonds, and real estate.

Flexible Lifestyle Choices

The absence of children allows DINK couples to maintain a more flexible lifestyle. They have the freedom to pursue career opportunities that may involve relocation or travel, without the constraints of parental responsibilities. This flexibility extends to their financial decisions, as they can adapt their spending and saving patterns to align with their lifestyle preferences and goals.

Retirement Planning

Planning for retirement is a crucial aspect of financial management for DINK couples. By starting early and maximizing their earning potential, they can build substantial retirement savings over time. Additionally, without the financial strain of supporting children, DINK couples may be able to retire earlier or pursue alternative retirement lifestyles, such as travel or entrepreneurship.

Read: Best Retirement Planning Strategies 2024

Estate Planning and Legacy Building

While DINK couples may not have biological children to inherit their wealth, they still have important considerations regarding estate planning and legacy building. They may choose to designate beneficiaries for their assets, including family members, friends, or charitable organizations. Estate planning allows them to ensure that their financial legacy aligns with their values and priorities.

Potential Challenges and Considerations

Despite the financial advantages of the DINK lifestyle, there are also potential challenges and considerations to be mindful of. DINK couples may face societal pressure or familial expectations regarding parenthood, which can impact their financial decisions. Additionally, they should plan for the possibility of changes in their circumstances, such as illness or disability, and ensure they have appropriate insurance coverage and contingency plans in place.

DINK is winning in the Economy

The global trend of double-income, No Kids (DINK) households is on the rise, driven by economic factors and changing societal norms. With the cost of raising children skyrocketing in many parts of the world, more couples are opting to remain childless. This choice isn’t just limited to Western or urban areas; it’s also prevalent in countries like India and China, where the financial burden of raising a child is a significant consideration.

In India, for example, the cost of raising a child to adulthood can be prohibitive for many middle-income families, leading to a rise in childless households. Similarly, in China, the high cost of living and economic pressures have contributed to a decline in birth rates, with many couples choosing to focus on their careers and financial stability instead. While the DINK lifestyle offers financial freedom and flexibility, it’s not without its challenges.

Governments express concerns about declining birth rates and the potential long-term economic consequences, while individuals grapple with questions about future care and companionship in old age. Ultimately, the decision to embrace the DINK lifestyle is a deeply personal one, influenced by a multitude of factors including financial considerations, personal preferences, and societal expectations.

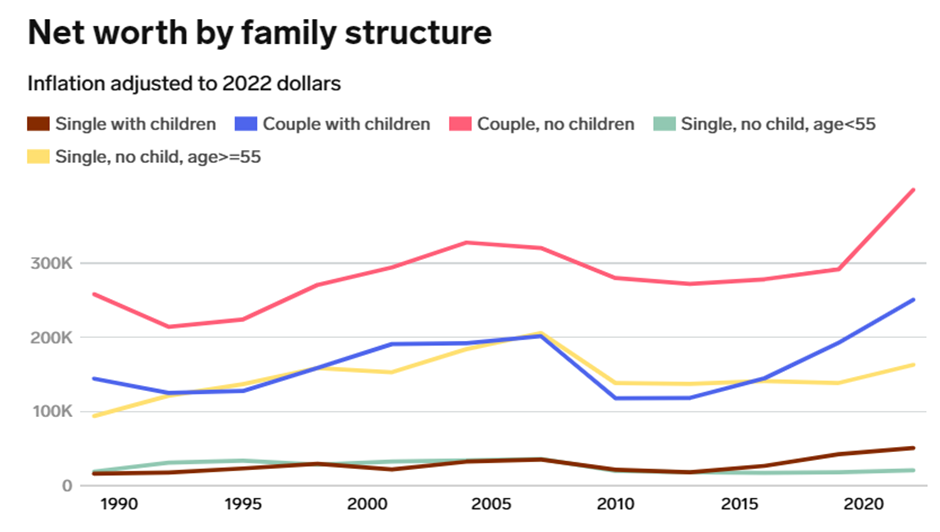

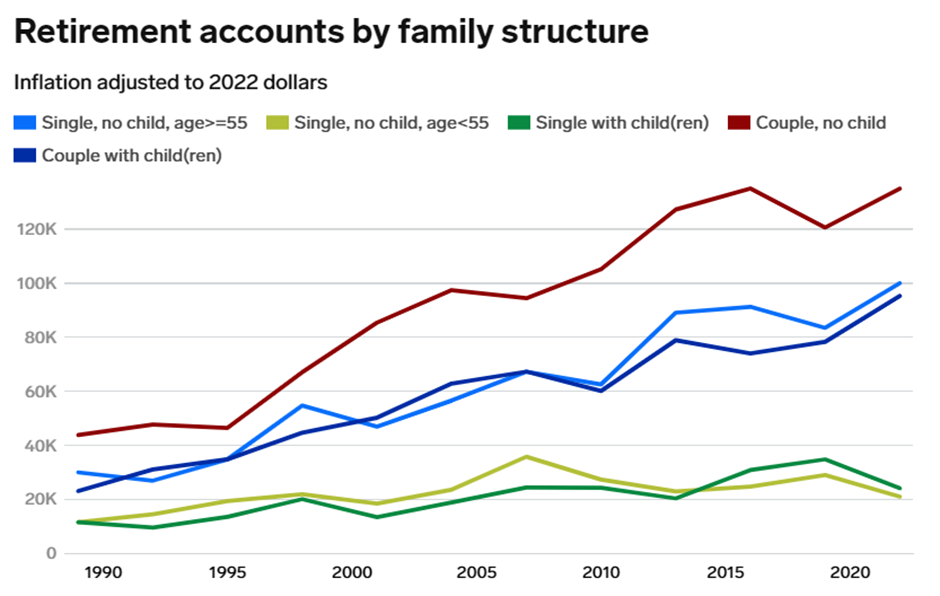

Some Interesting Data

Source: Survey of Consumer Finances (USA)

Source: Survey of Consumer Finances (USA)

Conclusion

The DINK lifestyle offers unique financial opportunities for couples who choose to forego parenthood. By leveraging dual incomes, prioritising savings and investments, and embracing flexibility in lifestyle choices, DINK couples can achieve greater financial freedom and security. However, it’s essential to approach financial planning thoughtfully and proactively, considering both short-term objectives and long-term goals.