SME Stocks in FY24

SME stocks have been quite the talk of the town in FY24, and not just because they’ve been doling out alpha returns like candy on Halloween. No, these little guys have been making waves for some less savory reasons too, with regulators shining a spotlight on suspected stock manipulation within this segment. But hey, every roller coaster ride has its ups and downs, right? So, let’s buckle up and take a closer look at how these SME stocks listed on NSE Emerge have fared in this wild ride we call the stock market.

Performance is Like Tale of Two Cities

As of March 22, 2024, there were about 93 stocks in the mix, and it’s like a tale of two cities with 72 of them strutting their stuff with positive returns. Here’s a quick rundown of the top performers:

– NPST SM: Leading the pack with a jaw-dropping gain of 738.43%, this stock is the belle of the ball.

– SURANI SM: Not too far behind, clocking in at 708.95%, this one’s definitely been turning heads.

– SWARAJ SM: With a respectable 615.27% gain, it’s been a smooth ride for investors in this stock.

– And the list goes on, with names like DYNAMIC, ABCOTS, and JSLL also putting in some impressive performances.

| Name | % Gain |

| NPST SM | 738.43 |

| SURANI SM | 708.95 |

| SWARAJ SM | 615.27 |

| DYNAMIC SM | 457.95 |

| ABCOTS SM | 455.45 |

| JSLL SM | 440.09 |

| CADSYS SM | 402.28 |

| SPECTRUM SM | 334.78 |

| ARHAM SM | 295.35 |

| KOTYARK SM | 248.09 |

| PHANTOMFX SM | 200.46 |

| RMDRIP SM | 198.8 |

| ANLON SM | 172.93 |

| AURDIS SM | 167.72 |

| KRISHNADEFSM | 166.27 |

| SRIVASAVI SM | 163.95 |

| VMARCIND SM | 144.85 |

| PARTYCRUS SM | 141.6 |

| PRITIKA SM | 141.14 |

| SYSTANGO SM | 139.46 |

| SHERA SM | 135.29 |

| ABINFRA SM | 131.16 |

| KHFM SM | 122.61 |

| EMKAYTOOLSSM | 119.39 |

| BAHETI SM | 114.7 |

| BEWLTD SM | 114.59 |

| IPSL SM | 111.9 |

| SHUBHLAXMISM | 107.41 |

| CMNL SM | 105.18 |

| ANNAPURNA SM | 105.12 |

| SOLEX SM | 102.86 |

| BETA SM | 96.99 |

| PRECISION SM | 89.15 |

| KORE SM | 87.53 |

| OMFURN SM | 80.73 |

| CONTI SM | 80 |

| DUGLOBAL SM | 78.58 |

| FOCE SM | 76.83 |

| INNOVANA SM | 75.24 |

| LLOYDS SM | 72.62 |

| AILIMITED SM | 72.46 |

| PROPEQUITYSM | 66.25 |

| SABAR SM | 61.25 |

| REXPIPES SM | 57.96 |

| BRIGHT SM | 55.86 |

| EUROBOND SM | 54.42 |

| LEMERITE SM | 52.08 |

| DOLLEX SM | 49.43 |

| PARIN SM | 40.77 |

| AGARWALFT SM | 40.54 |

| SHIGAN SM | 37.58 |

| ARIHANTACASM | 36.94 |

| SKP SM | 36.43 |

| KANDARP SM | 35.29 |

| AMEYA SM | 33.33 |

| VERTEXPLUSSM | 26.48 |

| JFLLIFE SM | 25 |

| MAHICKRA SM | 24.49 |

| ARISTO SM | 23.85 |

| KNAGRI SM | 23.43 |

| TIMESCAN SM | 23.12 |

| GOLDSTAR SM | 20.59 |

| GICL SM | 17.28 |

| SONUINFRA SM | 16.99 |

| MWL SM | 16.82 |

| FROG SM | 16.32 |

| PROLIFE SM | 9.1 |

| HOMESFY SM | 7.88 |

| LRRPL SM | 6.43 |

| MHHL SM | 6.03 |

| TAPIFRUIT SM | 1.49 |

| VITAL SM | 1.46 |

| CMRSL SM | -0.77 |

| SWASTIK SM | -1.32 |

| QMSMEDI SM | -5.89 |

| VIAZ SM | -6.08 |

| JAINAM SM | -6.95 |

| SMVD SM | -7.62 |

| COOLCAPS SM | -9.57 |

| UWCSL SM | -11.94 |

| NIDAN SM | -15.81 |

| MADHAVBAUGSM | -16.79 |

| VIVO SM | -18.44 |

| UMA SM | -18.87 |

| UCL SM | -19.56 |

| JALAN SM | -31.91 |

| RITEZONE SM | -36.19 |

| USASEEDS SM | -40.6 |

| GSTL SM | -61.25 |

| CLOUD SM | -72.83 |

| BMETRICS SM | -81.62 |

| CMMIPL ST | -85.83 |

| RILINFRA SM | -88.8 |

But it’s not all sunshine and rainbows in SME land. We’ve got our fair share of underperformers too, with 21 stocks ending up in the red for FY24. Tough break, folks.

Multibagger Stocks

Now, here’s where things get really interesting. Brace yourselves because a whopping 31 stocks have hit the coveted multibagger status, delivering returns of over 100%. That’s right, more than a third of the bunch have been knocking it out of the park! But hey, with great rewards come great risks, and not all investors have been so fortunate.

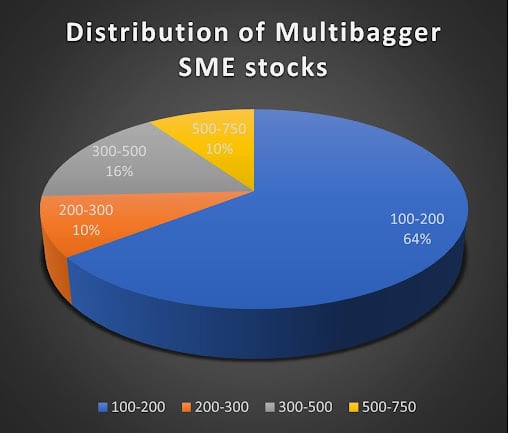

64% Multibagger Stocks gained between 100-200% Range

So, let’s crunch some numbers, shall we? Turns out, 64% of these multibagger stocks have seen returns in the 100-200% range, which is nothing to sneeze at. But there’s more! 10% of them have gone above and beyond, raking in returns of 200-300% and even 500-750%. Now that’s what I call hitting the jackpot! And for the lucky 16%, it’s been a wild ride with returns ranging between 300-500%.

Now, I know what you’re thinking: “Is investing in SME stocks worth the risk?” Well, my friend, that’s a question only you can answer. So, spill the beans! Do you have a favorite SME stock in your portfolio? And what are your thoughts on the risk factor? Share your thoughts in the comments below and let’s keep this conversation rolling!

Disclaimer: This post has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.