Cyclical stocks are the roller-coasters of the investment world, as legendary investor Peter Lynch aptly described them. Just like a roller-coaster ride that takes you from exhilaration to fear, cyclical stocks experience constant ups and downs, and they are far from a ‘forever’ bet in the world of finance.

Before delving deeper into the world of cyclical stocks, let’s first understand what they are. In the words of Peter Lynch, cyclical companies are those whose fortunes ebb and flow with the state of the economy, their performance intricately tied to the business cycle. These stocks encompass more than just commodities like steel, copper, and chemicals; they extend to sectors like commercial vehicles and capital goods. Even defence companies behave like cyclicals, as their earnings fluctuate based on government policies.

Read: Decoding Peter Lynch’s Investment Mastery

The complexity of predicting the movements of underlying commodity prices, which serve as the foundation for these stocks, makes investing in commodity cyclicals a challenging endeavour. These investments can yield significant returns in a short period, akin to a roller-coaster’s rapid twists and turns.

But why are cyclical businesses generally available at lower valuations?

The answer lies in their unpredictable earnings. The low price-to-earnings (P/E) ratios of these companies reflect the uncertainty in their income streams. It’s crucial not to compare the valuation of a cheap cyclical stock with that of a relatively expensive secular growth story.

Know more: Are Low P/E Stocks A Great Bargain Or A Trap?

Timing is everything when it comes to cyclical stocks

Buy them when they’re struggling, and sell when they’re thriving, assuming they aren’t headed for bankruptcy. The rapid swings in the business environment of these companies favour short to medium-term investors, a departure from the typical stock market where long-term investors reap the rewards.

The two critical points in investing in cyclical companies are timing the ‘entry’ and ‘exit.’

These stocks have a limited profitable holding period, and identifying the turning points in commodity cycles is no easy task, often resulting in losses for investors.

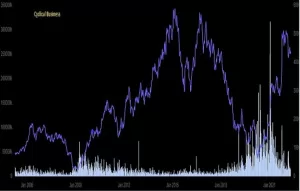

Consider a real chart of a cyclical stock, and you’ll notice how they flourish during economic upswings and suffer during downturns. A wrong entry point can lead to quick losses, and it may take years to see another upswing. In contrast, secular growth stocks exhibit a clear upward trend.

To drive the point home, it’s vital to get the entry and exit right when dealing with cyclical stocks. Betting on them should only happen when visible signs of a reversal emerge, rather than attempting to predict a reversal, which could mean missing out on part of the rally.

Valuing cyclical stocks relies heavily on underlying commodity prices. Investors should consider buying or selling these stocks when commodity prices approach a turning point. Attempting to analyse them based on cash flow or dividend yields is challenging, as future earnings projections are highly uncertain.

Interestingly, unlike secular growth stocks where P/E ratios rise in good times and fall in bad times, cyclical stocks exhibit the opposite pattern. When commodity prices decline, companies suffer losses, leading to lower earnings per share (EPS) and higher P/E ratios. Conversely, rising prices result in bumper earnings and lower P/E ratios.

In conclusion, the wisdom of Peter Lynch serves as a stern warning: “Cyclicals are like blackjack: stay in the game too long, and it’s bound to take back all your profit.” Cyclical stocks are not ‘forever’ investments like secular growth stocks. They are akin to a thrilling roller-coaster ride, with opportunities and pitfalls, and require careful timing and strategy to navigate successfully.