In the wake of the COVID-19 pandemic, a surprising trend emerged in India’s financial sector – a surge in personal loans. Let’s delve into the data released by the Reserve Bank of India (RBI) and uncover the intriguing dynamics behind this trend.

- Pandemic Pressures and Personal Loan Growth: As the pandemic cast its economic shadow, personal loans became a financial lifeline for many. Especially in states with lower per capita Net State Domestic Product (NSDP) like Bihar, Jharkhand, and Odisha, the growth in personal loans was notably higher. The reduced income levels, particularly in the unorganized sector, led lower-income households to seek credit to navigate financial difficulties.

- Diverse Uses of Personal Loans: Beyond conventional reasons like home and vehicle purchases, personal loans played a crucial role in helping people manage significant expenses related to health emergencies, weddings, travel, and more. The versatility of personal loans became evident as individuals sought financial support for various life events.

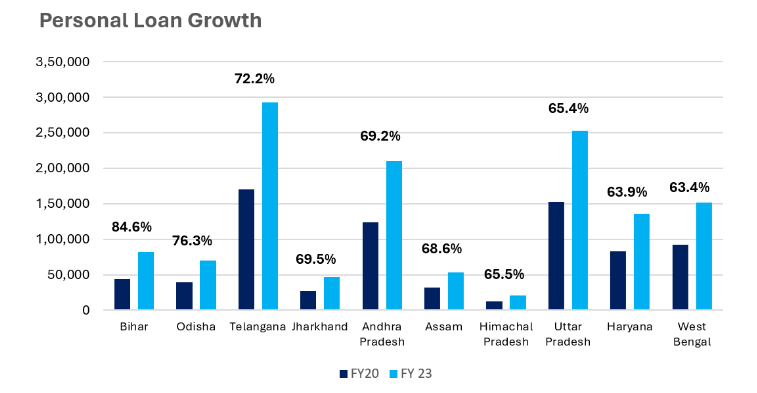

- State-wise Analysis: Analysing the RBI data on personal loan growth from FY20 to FY23, Bihar emerged as a surprising leader, experiencing an 85% growth. States like Odisha, Telangana, Jharkhand, and Andhra Pradesh also witnessed substantial increases. However, the concern arises in states with a higher proportion of low-income households, where repayment capacity might be limited.

- RBI’s Cautionary Stance: Over the past months, the RBI has issued warnings about the growing reliance on personal loans. Governor Shaktikanta Das urged lenders to strengthen internal checks, emphasizing the need for safeguards. Recent adjustments, such as increased risk weights on unsecured personal loans, reflect the regulatory body’s concerns.

- Regional Disparities in Outstanding Loans: When considering the total outstanding personal loans, high-income states like Maharashtra and Karnataka lead the pack. Maharashtra, with Rs 7.55 lakh crore in personal loans, tops the list, followed closely by Karnataka. South Indian states collectively represent a significant portion of outstanding personal loans, emphasizing the regional disparities in borrowing trends.

- Historical Perspective: Examining RBI data since FY04, a consistent increase in the demand for personal loans from scheduled commercial banks becomes evident. FY23 witnessed a remarkable 20% growth, the highest in the last six financial years. This growth surpasses the spikes observed during significant economic events like demonetization.

Read:

Conclusion:

The surge in personal loans amid the pandemic paints a complex picture of India’s financial landscape. While it served as a crucial financial tool for many, caution is warranted, especially in states with higher proportions of low-income households. The RBI’s proactive measures and increased scrutiny of unsecured loans indicate a recognition of the potential risks associated with this upward trend.