Introduction:

In the vast world of the stock market, where countless stocks and sectors beckon, finding the right investment opportunities can feel like solving a complex puzzle. As traders and investors, we often grapple with the challenge of discerning which sectors or stocks are primed for success amidst this sea of choices. History has shown us that sectors that once shone brightly can fade into obscurity in the blink of an eye. A prime example is the pharmaceutical sector, which enjoyed a remarkable bull run from 2011 until 2015 before regulatory issues transformed it into an underperformer.

The crucial question then arises: how can we identify when to pivot into or out of a specific sector? In the world of investing and trading, being aligned with market trends is paramount. Going against the trend can lead to financial setbacks. This is where Relative Rotation Graphs, or RRGs, come into play.

What Are Relative Rotation Graphs (RRGs)?

Relative Rotation Graphs, or RRGs, are a groundbreaking tool for analysing relative strength trends in the financial market. They allow investors to assess the relative performance of multiple securities compared to a common benchmark and each other. RRGs offer a unique advantage by visually representing relative performance and showcasing true rotation, a concept that is challenging to grasp using traditional linear charts.

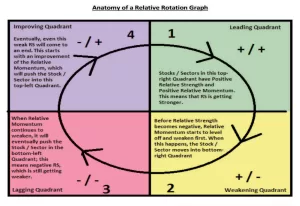

RRGs employ 4 quadrants to define the four phases of a relative trend:

- Leading quadrant: Securities in this quadrant exhibit strong relative strength and strong momentum.

- Weakening quadrant: Here, you’ll find securities with strong relative strength but weakening momentum.

- Lagging quadrant: This quadrant houses securities with weak relative strength and weak momentum.

- 4. Improving quadrant: Securities in this quadrant possess weak relative strength but improving momentum.

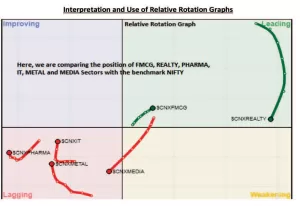

Using RRGs for Investment Insights:

Once you’ve identified a promising sector using RRGs, the next question is: which stocks within that sector should you consider for investment? The same principles used for sector selection apply to stock selection as well. For instance, if the RRG points towards a sector like consumer products, you might choose to increase your long exposure in companies such as Godrej Consumer Products, ITC, or Hindustan Unilever, while reducing positions in stocks like Tata Global and Marico, or even initiating short positions in Jubilant Foods.

Generating Pair Trade Ideas:

RRGs also lend themselves to pair trade idea generation. A straightforward strategy is to go long on sectors or elements entering or situated in the top-right quadrant and short on those entering or in the bottom-left quadrant.

Versatility of RRGs:

The application of Relative Strength analysis through RRGs is versatile and can assist investors at every stage of decision-making, from asset allocation to individual equity selection. Short-term traders may prefer shorter timeframes, while long-term investors opt for weekly or monthly analyses. Fixed income investors can utilize RRGs to make informed decisions about government or corporate bonds, regions, and credit levels. Forex traders can employ RRGs to evaluate multiple currencies against a base currency for trade ideas.

Conclusion:

In summary, Relative Rotation Graphs (RRGs) have consistently proven to be invaluable tools for identifying sector rotation and making informed investment decisions. RRGs not only help protect profits at the right time but also pinpoint emerging sectors for future investments. They offer a holistic view, enabling investors to compare all elements in their universe not only against a benchmark but also against each other. In this way, RRGs serve as indispensable monitoring tools to ensure that your investments stay on course to outperform their benchmark. With RRGs, you can unlock a wealth of investment insights and navigate the complex world of the stock market with confidence.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.