Introduction:

Derivatives are powerful financial instruments that offer traders the flexibility to adjust their positions, but only if they understand how to use them effectively. In this blog post, we’ll delve deeper into an intriguing concept – the synthetic straddle. Creating “synthetics” in the options market is a common practice, and this week, we’ll explore how to construct a synthetic straddle and identify optimal scenarios for employing this strategy.

Understanding the Straddle:

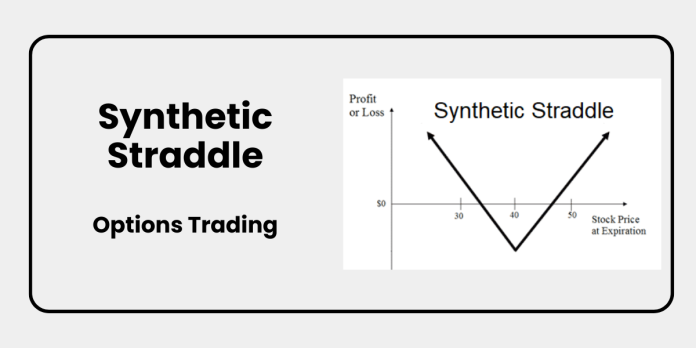

Before we dive into the world of synthetic straddles, let’s first grasp the fundamentals of a standard straddle. A straddle is a position that involves holding both a long call and a long put option with the same strike price and expiration date for an underlying asset. Typically, a straddle is a bet on increased volatility in the underlying asset. Traders often establish straddle positions in anticipation of significant macro-level events, such as government budget announcements or general elections.

Learn: An Introduction to Call and Put Options

The Unique Characteristics of a Synthetic Straddle:

Now, let’s shift our focus to the synthetic straddle, which boasts distinctive features compared to a traditional straddle. Imagine you’re holding two long-call contracts for an underlying asset, and the asset’s price has risen. However, you’re concerned that the upward trend may stall, potentially leading to a decline in your call options’ value due to time decay. Even worse, what if the asset’s price reverses, eroding your unrealized gains? In this scenario, you have several options to consider.

One approach is to take profits on your call options. Alternatively, if you wish to maintain your position while indirectly securing profits on your call options, you can contemplate shorting the underlying stock. This strategic move transforms your long call position into a synthetic straddle.

Creating a Synthetic Straddle:

To understand how a synthetic straddle is created, let’s delve into the concept of a synthetic put, which is equivalent to holding a long call and shorting the stock. This equivalence arises from the put-call parity argument, which asserts that a long call and a long bond (representing the present value of the call’s strike price) are equivalent to a long put and a long stock. By rearranging this equation, we can conclude that a long put is equal to a long call and a short stock, disregarding the bond component.

This means you have two options: you can either purchase a put option outright or create a synthetic long put position by simultaneously holding a long call and shorting the stock. Consequently, combining two long calls with a short stock position results in a synthetic straddle. The term “synthetic” reflects the strategy’s ability to replicate the risk-reward profile of a traditional straddle through a different combination of financial instruments.

Scenario: You hold a bullish view on Stock ABC, believing that its price will experience significant movement in the near future. To capitalize on this expected volatility, you decide to employ a synthetic straddle strategy.

Initial Position:

- You start by buying two call options on Stock ABC with a strike price of 40 and an expiration date. Each call option costs Rs 3, so the total cost of the two call options is Rs 600 (Rs 3 x 2*100 contract). The contract size is 100 shares.

Market Situation:

– Stock ABC is currently trading at Rs 40 per share.

– You own the two long call options with a strike price of 40.

Creating the Synthetic Straddle:

As time passes, you observe that Stock ABC has moved up to Rs 45 per share, and you’ve noticed some potential signs of a slowdown in the uptrend. To adapt to this evolving situation while maintaining flexibility in your position, you decide to create a synthetic straddle.

Step 1: Shorting Stock Future of ABC

– You short-sell 1 lot of ABC at the current market price of Rs 45 per share.

Step 2: Synthetic Straddle Formation

– By shorting 1 lot of the future of ABC, you effectively offset the bullish exposure from your long call options. This combination of the short stock future position and your existing long call options creates a synthetic straddle.

The Dynamic Nature of a Synthetic Straddle:

Now, let’s explore how a synthetic straddle behaves under different market conditions. If the underlying asset continues its upward trajectory, the long calls in your synthetic straddle will generate gains. One of the long calls will offset any losses resulting from the short stock position, while the other long call will accrue profits through intrinsic value.

Conversely, if the underlying asset experiences a decline from its current level, your long calls will lose value. However, your short stock position will generate gains as long as the asset’s price falls below your selling price minus the cost of the long calls.

Outcome Scenarios:

- Stock ABC Rises Further: If Stock ABC continues to climb, your long call options will gain intrinsic value, potentially offsetting any losses from your short stock position. The synthetic straddle allows you to participate in further upward moves while protecting against a significant downside.

- Stock ABC Declines: If Stock ABC drops from its current level, your long call options may lose value. However, your short stock position will generate gains as the stock’s price falls, helping to mitigate potential losses on the call options.

- Neutral Outcome: In the event that Stock ABC’s price remains relatively stable, the synthetic straddle position remains relatively unchanged, and you may incur minimal losses due to time decay on the call options.

Optional Reading:

It’s essential to note that initiating a position as a synthetic straddle is not recommended. This setup works best when you already have a long call position and decide to convert it into a synthetic straddle. By doing so, you effectively transform your bullish position into one that is direction-neutral, meaning it can profit regardless of whether the underlying asset moves up or down.

In conclusion, understanding synthetic straddles can enhance your options trading toolbox, providing a valuable strategy for adapting to changing market conditions while maintaining flexibility in your positions.