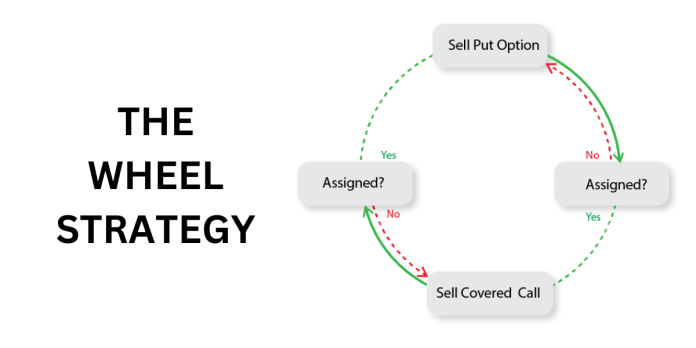

In the world of options trading, the Wheel Strategy stands out as a powerful technique for generating consistent returns while managing risk effectively. This strategy involves selling cash-secured puts to potentially acquire stock at a desired price or generate income, and then, if assigned, selling covered calls against the acquired stock. In this article, we will delve into the technical aspects of the Wheel Strategy, explore its benefits and risks, and provide a detailed example to illustrate its application.

Wheel Strategy

The Wheel Strategy is primarily employed by investors who are bullish or neutral on a particular stock or market. It involves three main steps:

- Selling Cash-Secured Puts: The process starts by selling put options on a stock that the investor wouldn’t mind owning at a specific strike price (usually slightly below the current market price). By selling puts, the investor collects a premium, which serves as income. If the stock price remains above the strike price until expiration, the put option expires worthless, and the investor keeps the premium.

- Acquiring Stock: If the put option is exercised (i.e., the stock price falls below the strike price), the investor is obligated to buy the stock at the strike price. However, since the puts are cash-secured, the investor has already set aside enough cash to purchase the stock at the agreed-upon price.

- Selling Covered Calls: Once the investor owns the stock, they can sell covered calls against it. By selling calls, the investor receives another premium, which adds to their income. If the stock price remains below the call strike price until expiration, the call option expires worthless, and the investor keeps the premium.

Benefits of the Wheel Strategy

- Income Generation: The strategy allows investors to generate income by collecting premiums from selling puts and calls.

- Potential Stock Acquisition at a Discount: If assigned, investors can acquire stocks at a lower price than the current market price.

- Risk Management: The strategy involves defined risk, as the investor knows the maximum loss potential upfront.

- Flexibility: Investors can adjust their positions based on market conditions and their outlook on the underlying stock.

Risks of the Wheel Strategy

- Stock Price Decline: If the stock price declines significantly after selling puts, the investor may incur losses on the stock they are obligated to purchase.

- Opportunity Cost: If the stock price rallies strongly after selling puts, the investor may miss out on potential gains.

- Limited Upside: Selling covered calls caps the potential upside if the stock price rises above the call strike price.

Example of the Wheel Strategy

Let’s consider an example using stock IDFC, which is currently trading at Rs 118.15 per share. The investor believes that IDFC will remain relatively stable or increase slightly in the near term.

-

Selling Cash-Secured Puts

- Sell 1 put option contract with a strike price of Rs 116 and expiration in one month.

- Premium received: Rs 1.90 per share (Rs 9500 per contract).

-

Acquiring Stock

- If IDFC remains above Rs 116 at expiration, the put option expires worthless, and the investor keeps the Rs 9500 premium.

- If IDFC falls below Rs 116, the investor is assigned and buys 2500 shares of IDFC at Rs 116 per share, using the Rs 5,80,000 set aside as collateral.

-

Selling Covered Calls

- After acquiring IDFC stock, sell 1 call option contract with a strike price of Rs 120 and expiration in one month.

- Premium received: Rs 1.75 per share (Rs 8750 per contract).

- If IDFC remains below Rs 120 at expiration, the call option expires worthless, and the investor keeps the Rs 8750 premium.

- If IDFC rises above Rs 120, the investor’s stock may get called away, but they sell it at Rs 120, locking in a profit.

Here in the above strategy, we get around 1.45% to 1.67% returns per month which are between 17.55% to 20.06% returns annually.

The Wheel Strategy offers a systematic approach to generating income and potentially acquiring stocks at favourable prices. By understanding its mechanics, benefits, and risks, investors can effectively implement this strategy to enhance their portfolio returns while managing risk exposure. However, like any trading strategy, thorough research, risk management, and disciplined execution are essential for success.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.