Futures and options contracts offer investors powerful tools to manage risk and leverage, but their potent nature demands responsible handling. One key regulatory lever employed to maintain market stability is the Futures and Options (F&O) ban, a temporary restriction on opening new positions in specific underlying securities.

What is F&O Ban?

The primary driver of an F&O ban is excessive open interest (OI), a metric representing outstanding futures and options contracts for a particular security. When OI surpasses 95% of the Market-Wide Position Limit (MWPL), designated by exchanges like NSE and BSE, it indicates potentially destabilizing speculative activity. High OI signifies concentrated positions, amplifying price movements and raising systemic risk concerns.

Why Ban?

In academic discussions about banning futures and options (F&O) trading, scholars use different theories to understand the reasons behind such bans. Supporters of market efficiency believe that too much open interest (OI), which represents outstanding contracts, can disrupt the normal balance of supply and demand, making it harder to determine fair prices. Behavioral finance experts focus on how concentrated markets with high OI can trigger extreme emotions like fear or excitement, leading to irrational behavior and market fluctuations. Moreover, research on investor coordination and manipulation reveals that big players can take advantage of high OI situations for unfair gains.

Read: Exploring Open Interest In Futures

Banning the Speculators, Protecting the System

The mechanics of an F&O ban are straightforward. Once triggered, new positions in the affected security’s futures and options contracts are prohibited. However, existing positions can be squared off through offsetting trades. This temporary pause aims to:

- Curb volatility: By slowing down speculation, the ban reduces rapid price swings that could be detrimental to market stability.

- Prevent manipulation: High OI environments are susceptible to coordinated manipulation attempts. The ban restricts the ability of such schemes to take hold.

- Promote market integrity: A level playing field is essential for fair competition and investor confidence. F&O bans ensure that excessive leverage and speculation don’t distort market operations.

F&O banned stocks on Thursday

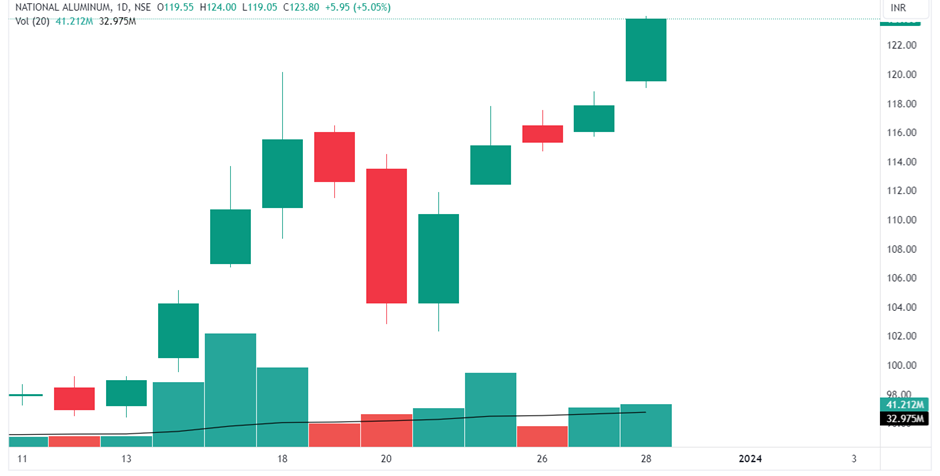

National Aluminium Co. Ltd

Despite of F&O ban the stock is having a massive surge after the 52-week breakout. There is volume in the cash segment due to which stock is rising. The ban on this stock may trigger the unwinding of longs and may cause this bullish jump.

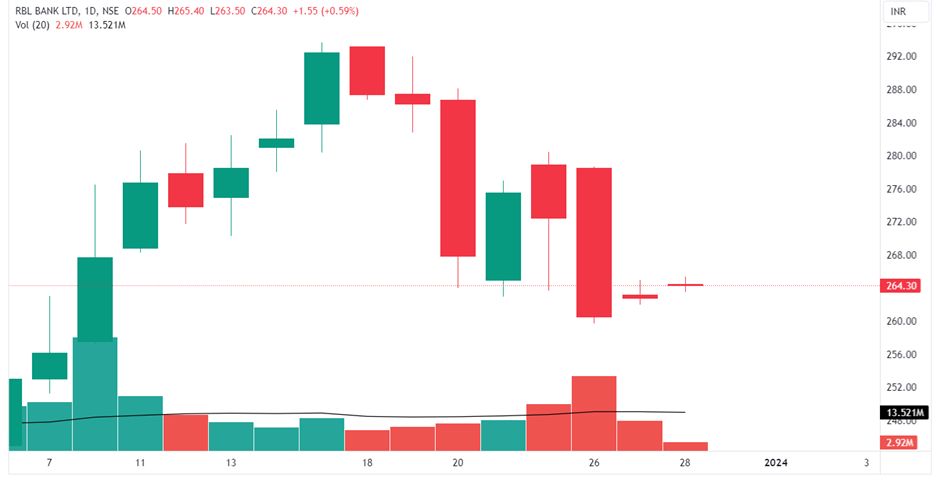

RBL Bank Ltd

Due to the F&O ban on this stock, trading activity has dropped at RBL Bank. The stock is trading with a doji candle where there are none of the bulls in control nor the bears.

F&O bans represent a delicate balancing act between facilitating financial innovation and safeguarding market stability.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.