With a bit of mindfulness and strategic planning, you can find smart ways to save money without sacrificing your lifestyle.

-

Meal Planning and Cooking at Home

Eating out frequently can take a toll on your budget. Consider planning your meals for the week, creating a shopping list, and cooking at home.

Let’s say you spend Rs 300 per meal when dining out. By cooking or eating at home, you could reduce that cost to Rs 100 per meal, saving Rs 200 per day. Over a month (assuming 10 meals), that’s a savings of Rs 2,000. Annually it comes down to Rs 24,000.

-

Cutting Down on Daily Coffee Shop Visits

If you’re a regular at coffee shops, those daily cappuccinos or lattes can add up quickly. A Rs 150 coffee each workday amounts to Rs 750 per week.

By investing in a good quality coffee maker and making your coffee at home for Rs 20 per cup, you can save Rs 130 per day or Rs 650 per week. In a month, that’s a significant Rs 2,600 in savings.

-

Optimizing Grocery Shopping

Grocery expenses can also be optimized. Compare prices across stores, buy generic brands, and take advantage of discounts and loyalty programs.

Assume you spend Rs 5,000 on groceries per month. By optimising your shopping habits and saving just 10%, you could pocket an extra Rs 500 monthly.

-

Reviewing Subscription Services

Subscription services like streaming platforms, magazines, or dining memberships often come with recurring fees. Assess which ones you truly use and enjoy.

If you can cut down on just one monthly subscription of Rs 500, that’s Rs 6,000 in savings over a year.

-

Conserving Energy and Water

Reducing your utility bills not only helps the environment but also your wallet. Simple measures like turning off lights and appliances when not in use can make a difference.

Suppose you trim Rs 200 off your monthly electricity bill and Rs 50 off your water bill. That’s a total monthly savings of Rs 250, adding up to Rs 3,000 annually.

-

Carpooling or Using Public Transportation

If you commute to work daily, consider carpooling with colleagues or using public transportation. Let’s say you save Rs 300 per week on fuel costs by carpooling.

Over a year, that’s Rs 15,600 in savings. Additionally, public transportation can provide even more substantial savings.

-

Avoiding Impulse Buys

Impulse purchases can quickly drain your wallet. Before buying non-essential items, ask yourself if it’s a need or a want. If it’s the latter, consider waiting 24 hours before making the purchase.

Cutting down on impulse buys by just Rs 200 per week translates to Rs 800 in monthly savings and Rs 9,600 annually.

-

Negotiating Bills and Subscriptions

Don’t be afraid to negotiate your bills. Whether it’s your internet, cable, or insurance, companies often have promotions or discounts available.

A Rs 200 reduction in your monthly bills across various services could result in Rs 2,400 in annual savings.

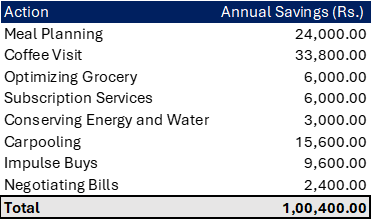

Let’s break down the potential savings from the examples mentioned above and see how these small changes can add up to a significant total. Get ready to be amazed by the cumulative effect of these practical strategies on your yearly savings!

These calculations are tailored for individuals who are employed and enjoy a substantial income.

You’ve successfully saved Rs 1,00,000 simply by making intelligent financial decisions and opting for efficient solutions.

Conclusion: Building a Strong Financial Future with Small Changes

By making these smart adjustments to your daily habits, you could potentially save thousands of rupees annually. While each individual change might seem small, the cumulative impact is substantial.

Remember, the money you save can be redirected towards building an emergency fund, investing, or achieving specific financial goals. By adopting these smart money-saving strategies, you not only fortify your current financial situation but also pave the way for a more secure and prosperous future.

Read: Building an Emergency Fund: A Financial Lifeline

Disclaimer: This blog has been written exclusively for educational purposes. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions