Tring Tring! Your phone rings, and you pick up the call to find a persuasive executive on the other end pitching you a loan. Your mind immediately races to the upcoming important event at your place, be it a grand wedding or a much-needed home renovation. As the executive delves into the details, you hear the magical words: 8% interest rate. It sounds like a great deal, right? But wait, before you sign on the dotted line, have you ever wondered about the difference between flat and reducing interest rates?

In the world of loans, there are generally two primary categories: flat rate loans and reducing interest rate loans. Each has its own set of rules, implications, and financial outcomes. Let’s dive into the nitty-gritty of both, so you can make an informed decision about that loan you’re considering.

Flat Rate Loans: The Deceptive Simplicity

Flat interest rate loans are the darlings of Non-Banking Financial Companies (NBFCs). They lure you in with their simplicity, but there’s a catch. Here’s how they work:

- Static Interest Calculation: Interest payments are calculated based on the initial loan amount. It doesn’t change throughout the loan tenure.

- EMI Juggernaut: The Equated Monthly Installment (EMI) you pay comprises both constant interest payments and principal repayments throughout the loan term.

- Straightforward, Yet Costly: Flat interest rate loans offer a straightforward and easily comprehensible structure. However, it’s crucial to be aware of a notable drawback: these loans often result in higher overall interest costs, especially when used for long-term financing. This is due to the fact that you continue to pay interest on the entire principal amount for the entire duration, even as you make periodic principal repayments.

Here is a table illustrating Flat interest rate scenario

Loan amount = 100,000, interest rate = 8%, Tenure = 1 year

| Month | Opening balance | Interest payment | Principal Repayment | EMI | CLosing balance |

| 0 | – | – | – | 1,00,000.00 | |

| 1 | 1,00,000.00 | 666.67 | 8,333.33 | 9,000.00 | 91,666.67 |

| 2 | 91,666.67 | 666.67 | 8,333.33 | 9,000.00 | 83,333.33 |

| 3 | 83,333.33 | 666.67 | 8,333.33 | 9,000.00 | 75,000.00 |

| 4 | 75,000.00 | 666.67 | 8,333.33 | 9,000.00 | 66,666.67 |

| 5 | 66,666.67 | 666.67 | 8,333.33 | 9,000.00 | 58,333.33 |

| 6 | 58,333.33 | 666.67 | 8,333.33 | 9,000.00 | 50,000.00 |

| 7 | 50,000.00 | 666.67 | 8,333.33 | 9,000.00 | 41,666.67 |

| 8 | 41,666.67 | 666.67 | 8,333.33 | 9,000.00 | 33,333.33 |

| 9 | 33,333.33 | 666.67 | 8,333.33 | 9,000.00 | 25,000.00 |

| 10 | 25,000.00 | 666.67 | 8,333.33 | 9,000.00 | 16,666.67 |

| 11 | 16,666.67 | 666.67 | 8,333.33 | 9,000.00 | 8,333.33 |

| 12 | 8,333.33 | 666.67 | 8,333.33 | 9,000.00 | 0.00 |

In summary, flat rate loans are the straightforward choice, but borrowers should carefully consider their long-term financial implications, as they can potentially lead to higher overall interest expenses.

Calculate EMI using the Free Online EMI Calculator

Reducing Interest Rate Loans: Building Equity Gradually

Reducing rate loans, primarily favored by banks, adhere to a systematic amortization schedule, setting them apart from flat rate loans. Here’s a closer look at their dynamics:

- Diminishing Interest Burden: These loans calculate interest payments based on the outstanding balance rather than the initial loan amount, resulting in a diminishing interest burden over time.

- Equity Builder: Month by month, as the loan matures, the interest payments decrease, allowing borrowers to progressively allocate a more substantial portion of their payments toward reducing the principal.

- Long-Term Advantage: Reducing interest rate loans are especially advantageous for the long term, offering borrowers a unique opportunity to accumulate equity by systematically chipping away at the principal balance.

- Front-Loaded, But Worth It: During the initial phases of the loan, a significant proportion of each payment is directed towards covering the interest, leaving only a modest sum for principal reduction. However, as time passes, this equation flips in your favor.

Loan amount = 100,000, interest rate = 8%, Tenure = 1 year

| Month | Opening balance | Interest payment | Principal Repayment | EMI | Closing balance |

| 0 | – | – | – | – | 1,00,000.00 |

| 1 | 1,00,000.00 | 666.67 | 8,032.18 | 8,698.84 | 91,967.82 |

| 2 | 91,967.82 | 613.12 | 8,085.72 | 8,698.84 | 83,882.10 |

| 3 | 83,882.10 | 559.21 | 8,139.63 | 8,698.84 | 75,742.47 |

| 4 | 75,742.47 | 504.95 | 8,193.89 | 8,698.84 | 67,548.58 |

| 5 | 67,548.58 | 450.32 | 8,248.52 | 8,698.84 | 59,300.06 |

| 6 | 59,300.06 | 395.33 | 8,303.51 | 8,698.84 | 50,996.55 |

| 7 | 50,996.55 | 339.98 | 8,358.87 | 8,698.84 | 42,637.68 |

| 8 | 42,637.68 | 284.25 | 8,414.59 | 8,698.84 | 34,223.09 |

| 9 | 34,223.09 | 228.15 | 8,470.69 | 8,698.84 | 25,752.40 |

| 10 | 25,752.40 | 171.68 | 8,527.16 | 8,698.84 | 17,225.24 |

| 11 | 17,225.24 | 114.83 | 8,584.01 | 8,698.84 | 8,641.23 |

| 12 | 8,641.23 | 57.61 | 8,641.23 | 8,698.84 | 0.00 |

Here is a table illustrating Reducing interest rate scenario

In summation, reducing interest rate loans, favored by banks, fosters a dynamic that steadily builds equity over time. While they may exhibit a front-loaded interest structure, borrowers often reap the rewards of lower EMIs and interest payments when compared to their flat-rate counterparts. This makes them an attractive choice for long-term financial planning.

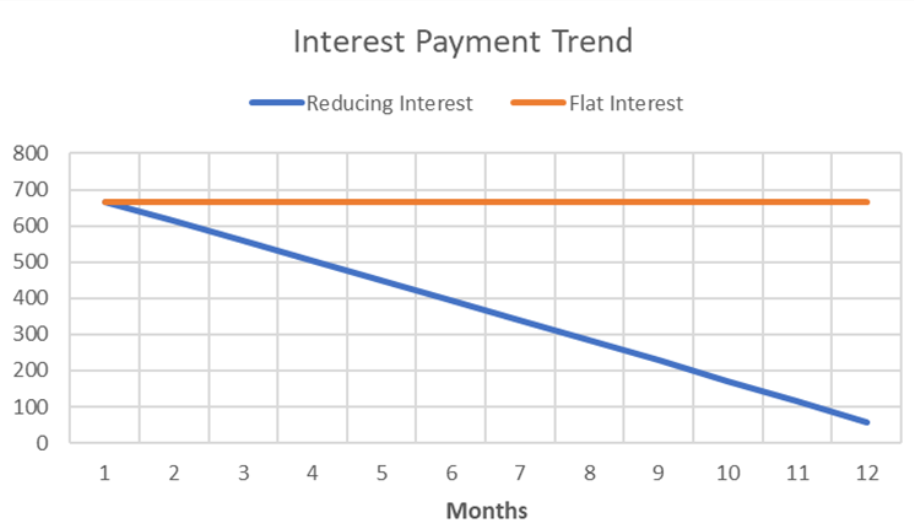

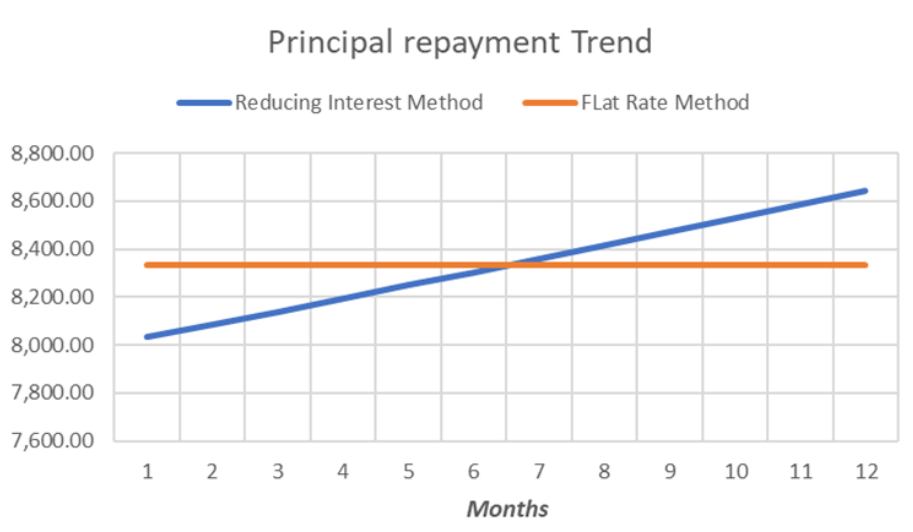

Now, let’s delve into the trends of interest payments and principal repayments with some illustrative charts, and by the end of this blog post, you’ll be well-equipped to make a sound financial decision for your upcoming event or renovation.

Understanding these two types of loans is crucial, especially when you’re on the precipice of a significant financial commitment. So, before you make that call to the loan executive, make sure you’ve grasped the difference between flat and reducing interest rates to ensure your financial future stays on track.