The Consumer Price Index (CPI) is a key economic indicator that measures the change in the price of a basket of goods and services commonly purchased by households. It is widely used by central banks and governments to monitor inflation, which is the rate at which prices are rising.

The CPI is calculated by collecting the prices of a representative basket of goods and services over time and comparing them to the prices in a base period. The CPI is then calculated using the following formula: CPI = (Cost of the market basket in the current year / Cost of the market basket in the base year) x 100 A higher CPI indicates inflation, while a lower CPI indicates deflation.

The CPI is used in a variety of ways such as to calculate inflation-adjusted returns on investments, set interest rates on loans and credit cards, index wages and benefits, and adjust national income and product accounts for inflation.

Read: All you Need to Know about Inflation

Examples of how the CPI is used:

- A bank might use the CPI to adjust the interest rate on a variable-rate mortgage.

- An investment fund might use the CPI to adjust the value of its portfolio for inflation.

- A financial analyst might use the CPI to compare the performance of two companies in different industries.

Limitations of the CPI:

- The CPI does not take into account changes in the quality of goods and services. For example, if the quality of a good or service improves, the CPI may not accurately reflect the true change in price.

- The CPI does not account for differences in the cost of living in different geographic areas. For example, the cost of living is generally higher in major cities than it is in rural areas.

- The CPI can be volatile in the short term due to factors such as food and energy prices.

Despite its limitations, the CPI is a valuable tool for measuring inflation and its impact on the economy.

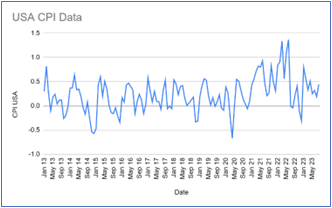

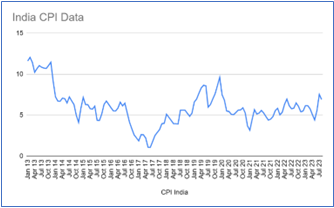

Below are the charts of CPI data (All Items) for India and the USA:

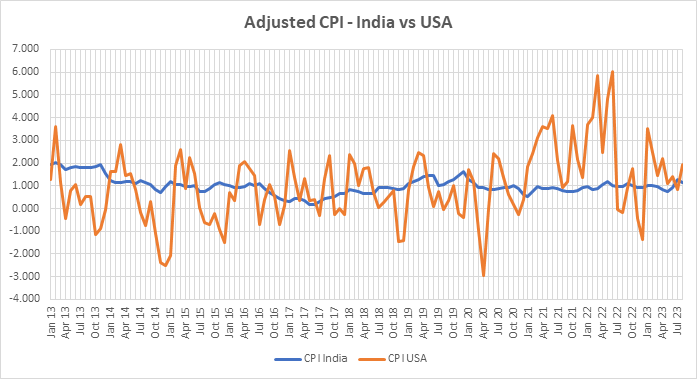

We have collected CPI data for both India and the USA. To facilitate a meaningful comparison, we have scaled each observation by dividing it by the respective country’s mean CPI value derived from all observations. This scaling allows us to make a more accurate comparison between the two countries. The chart below illustrates the volatility of the scaled CPI numbers, which we refer to as “Adjusted CPI.”

Source- Federal Reserve Economic Data

The fact that the US Adjusted CPI is more volatile than the Indian Adjusted CPI could mean a number of things.

- The US economy is more susceptible to shocks. This could be due to a number of factors, such as its size and complexity, its openness to trade, and its reliance on financial markets.

- The US has a more flexible price system. This means that prices in the US are more likely to adjust quickly to changes in supply and demand.

- The US government is more responsive to inflation. This could lead to more aggressive monetary and fiscal policy interventions, which can also lead to more volatility in the CPI.

Here are some specific examples of shocks that could have caused the US Adjusted CPI to be more volatile than the Indian Adjusted CPI:

- The COVID-19 pandemic. The pandemic caused supply chain disruptions and disruptions to economic activity, which led to sharp swings in prices for certain goods and services.

- The war in Ukraine. The war has caused energy prices to rise sharply, which has also contributed to higher inflation in the US.

- Fiscal stimulus. The US government has responded to the pandemic and the war in Ukraine with significant fiscal stimulus, which has put upward pressure on prices.

It is important to note that the volatility of the CPI is not necessarily a bad thing. In fact, it can be a sign of a healthy economy that is responding to changes in supply and demand. However, it can also make it difficult for policymakers to set monetary and fiscal policy.

Read: Fiscal Policy: The Government’s Economic Toolbox

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.