Capital Markets: The Engine of Economic Prosperity

In today’s financial landscape, it’s impossible to imagine a world without banks, stock markets, or money markets. Yet, not too long ago, wealth was appraised solely through land, livestock, and labor. Nowadays, Capital markets stand as an irreplaceable cornerstone of any modern economy as a tool of measuring wealth, a dynamic yet innovative and influential force that connects economic agents and investors alike.

Why are capital markets indispensable to any nation? Here’s an exploration:

- Efficient Capital Allocation: Capital markets empower businesses, from startups to large corporations, by facilitating access to resources for expansion and innovation. Unimpeded capital flow directs investments towards high-return projects, driving economic progress.

- Nurturing Entrepreneurship: Capital markets provide a platform for entrepreneurs to transform ideas into reality by attracting a diverse range of investors. This ecosystem fosters innovation, competition, and the emergence of new products and industries.

- Wealth Generation and Retirement Planning: Participation in capital markets empowers individuals to grow wealth over time through stocks, bonds, and other instruments. This enables strategic retirement planning and the creation of a financial legacy, contributing to economic stability.

- Diversification and Risk Mitigation: Capital markets offer diverse investment options, allowing investors to spread risk across assets and mitigate market volatility, thereby safeguarding investments and enhancing financial system stability.

- Government Financing: Governments utilize capital markets to fund vital public projects like infrastructure, healthcare, and education through bonds and securities issuance. This benefits citizens through improved infrastructure and stimulates economic growth.

- Attracting Foreign Investment: Strong and transparent capital markets attract foreign investors, boosting a nation’s economic strength. This leads to increased economic activity and job opportunities.

In the symphony of a nation’s economy, capital markets emerge as the conductor orchestrating growth, innovation, and prosperity. A quintessential exemplar of this phenomenon can be found in the Indian Capital Markets—a story of transformation from modest origins to global financial eminence.

The Indian capital markets have embarked on an extraordinary path of evolution, transcending humble beginnings to become a juggernaut in global finance. This journey bears testament to India’s resolute commitment to economic development and its adaptability in the ever-shifting terrain of global finance.

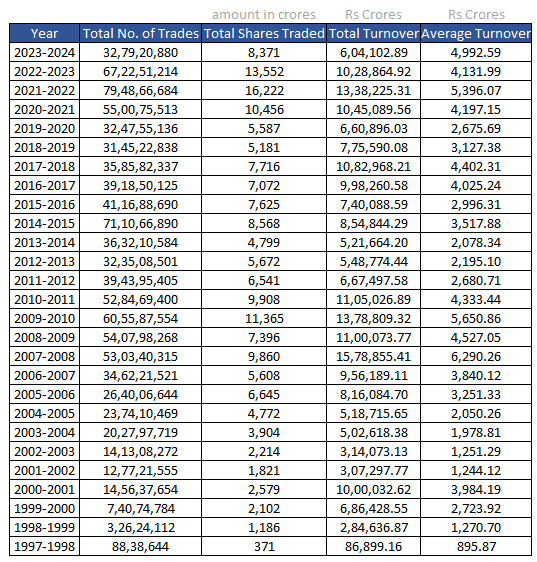

The Bombay Stock Exchange (BSE), India’s venerated stock exchange had a turnover of Rs 86,899.16 Crore in the year 1997-1998 for Equity Segment which rose up to Rs 1,028,864.92 Crore in the year 2022-2023 with a CAGR of 9.97% over 26 years signifying a monumental leap in market activity.

Indian capital markets have not merely expanded exponentially but have also garnered international acclaim. By May 2023, India had reclaimed its position as the world’s fifth-largest market, a result of a robust rally in local equities. Following a brief relinquishing of this ranking to France in January, India’s stock market resurgence underscored its stature as a formidable player on the global financial stage.

India’s capital markets have burgeoned into a vibrant ecosystem encompassing a diverse array of financial instruments, including stocks, bonds, commodities, and derivatives. The introduction of sophisticated financial instruments such as stock index futures and options has not only deepened market liquidity but has also attracted a broad spectrum of investors, ranging from individual traders to institutional behemoths.

Regulatory Reforms: The Pillar of Progress

The progress of Indian capital markets owes much to prudent regulatory reforms. The Securities and Exchange Board of India (SEBI) has played an instrumental role in fortifying market integrity, ensuring investor protection, and fostering transparency. Pivotal regulatory changes, including the introduction of share dematerialization, rigorous corporate governance standards, and the digitization of stock trading, have ignited investor confidence and participation.

Global Connectivity and Technological Advancements

Indian capital markets have wholeheartedly embraced globalization, magnetizing foreign institutional investors (FIIs). This global outreach has not only bolstered India’s economic prowess but has also diversified the investor landscape, thereby stimulating increased economic activity and job creation. Moreover, technology has been an instrumental catalyst for progress in Indian capital markets. The advent of electronic trading platforms has revolutionized market efficiency, democratizing market access and enabling investors from every corner of the country to participate seamlessly.

The Road Ahead

The journey of progress in Indian capital markets is an ongoing saga of promise. India’s unwavering dedication to economic growth, coupled with ongoing regulatory reforms, is poised to fortify market resilience further. This, in turn, will beckon global investments and cement India’s position on the global financial stage.

In conclusion, capital markets serve as the lifeblood of economic growth, nurturing innovation, and propelling prosperity. The Indian Capital Markets’ remarkable transformation showcases the nation’s determination and adaptability, painting a vivid picture of how a commitment to progress can transform modest beginnings into global financial eminence.