In the thrilling world of cryptocurrency, 2023 has been nothing short of a rollercoaster ride. Picture this: Bitcoin skyrocketing to unimaginable heights, a courtroom drama that sets tongues wagging, and the anticipation of groundbreaking approvals. It all began when Bitcoin crossed the monumental $31,000 mark on a fateful Monday. But that was just the beginning. In a matter of minutes, the digital juggernaut smashed through $32,000, $33,000, $34,000, and, yes, even $35,000. It felt like a crypto adrenaline rush, and the excitement didn’t stop there.

As the cryptocurrency cosmos watched in awe, events involving Terra USD and Luna set off a chain reaction, triggering defaults, bankruptcies, and regulatory actions that would leave a lasting mark on the industry. But let’s not get ahead of ourselves.

The real star of this story is Bitcoin, and its recent surge defies all expectations. Throughout 2023, it seemed as though Bitcoin was cautiously testing the $30,000 price threshold, only to retreat. The face of potential banking crises loomed large. However, this week brought a tectonic shift, fueled by some truly exciting developments.

Monday saw a US appeals court delivering a resounding victory to crypto asset manager Grayscale, igniting a wildfire of speculation in the market. The burning question on everyone’s mind: When will the US Securities and Exchange Commission (SEC) give the green light for a cryptocurrency-linked exchange-traded fund (ETF)? And this wasn’t the first time Bitcoin got a boost from ETF optimism. Just a week prior, rumors swirled about the SEC’s approval of BlackRock’s spot Bitcoin ETF, driving a 10% intraday price surge. But the enthusiasm was short-lived, as reality set in—no approval yet.

Bitcoin, like a wild stallion, reared back from its recent highs on Tuesday, as traders came to terms with the fact that while ETF progress may be inevitable, it’s still weeks or possibly months away.

So, what does all this mean for the world of cryptocurrency? The emergence of the ETF narrative has been a boon for Bitcoin enthusiasts, propelling its price to more than double year to date. But it’s still a far cry from its record high of nearly $69,000 in 2021. The stage is set for an “ETF war,” with BlackRock, Invesco, and Fidelity vying for supremacy.

But, as they say, times have changed since 2021. Bitcoin now faces a more challenging landscape, marked by rising US Treasury yields, market caution, and a series of unfavorable headlines related to the Bankman-Fried trial. These factors loom large as obstacles for the digital asset class.

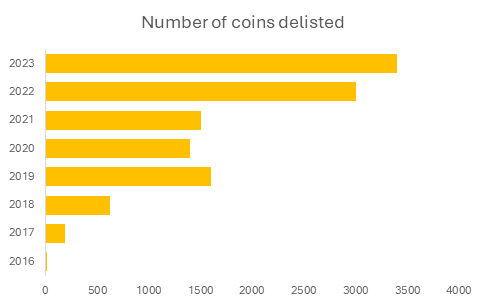

Charting the Trend of Delisting Crypto Tokens

Source: Kaiko

And yet, Bitcoin’s ascent continues, fueled by fear and uncertainty. In times of market turbulence, investors seek refuge and diversification, and Bitcoin stands as a digital safe haven, often referred to as ‘digital gold.’ It’s become a means for investors to venture beyond traditional stocks and bonds, embracing the cryptocurrency frontier.

Read: Power Of Crypto And Cryptocurrency Exchanges

In this ever-evolving saga, 2023’s Bitcoin rally promises to be a tale worth telling. Join us as we delve deeper into the heart of the action, dissecting the highs, the lows, and the tantalizing possibilities that lie ahead.

Disclaimer: This blog is for educational purposes only. The mentioned securities are for example purposes and not recommendations. It is based on various secondary sources on the internet and is subject to change. Please consult an expert before making related decisions.