JP Morgan announced on September 22, 2023, that it would include India in its Emerging Market Bond Index (EMBI) Global Diversified and EMBI Global indices, effective from early to mid-2024. This is a significant development for the Indian economy, as it will make it easier for foreign investors to invest in Indian bonds and will help to attract more foreign investment to India. JPMorgan said Indian bonds will eventually hold a weight of 10% in its index, following 1% additions to its weightage each month from next June.

Many funds linked to the JP Morgan emerging market bond index that now features India are actively managed, implying the impact of overseas flows could be felt as early as December when global investors decide on fresh allocations for the next calendar year.

In recent conversations with market participants, JP Morgan’s index managers have said that around 75% of the assets under management (AUM) linked to the bond indices are ‘active’, and that the total AUM tracking the platforms could be more than Rs. 24,96,900 crore (USD 300 billion), sources aware of the matter told ET.

Foreign holdings of outstanding bonds could rise to 3.4% by April-May 2025, from 1.7% currently and the inclusion could result in inflows of more than 6X of the current number close to Rs 29,132.25 crore (USD 3.5 billion), according to analyst estimates.

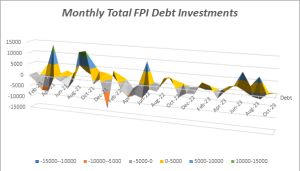

Overall, the trend was mixed from February 2021 to October 2023, but moving along with the remaining 2023 we will be able to see the inflows impacting the bond market.

Source – NSDL website

Source – NSDL website

Read: Bonds: A Great Way To Invest For Income & Safety

Active vs Passive Management

Active management is an investment strategy that seeks to outperform a benchmark index by making buy and sell decisions based on research and analysis. Active managers may overweight or underweight certain sectors or securities in order to generate higher returns. On the other hand, Passive management is an investment strategy that aims to replicate the performance of a benchmark. Passive managers do not make any active decisions about which securities to buy or sell.

Aftermath

- The Indian government began discussing the inclusion of its securities in global indices for a decade. However, its restrictions on foreign investments in domestic debt held back for India.

- India’s growing economy (7.8% GDP growth rate) and financial market reforms have made Indian bonds more attractive to foreign investors. The RBI has made it easier for foreign investors to buy Indian bonds, which is expected to bring more foreign money into India.

- This could benefit the Indian economy in a number of ways, such as making the rupee stronger and lowering borrowing costs for businesses and the government.

However, increased foreign flows will also make the bond and currency markets more volatile and could push the government and central bank to intervene more actively.

Disclaimer: The above article is for educational purposes only and not a recommendation. Please take the advice of a professional before investing.