Overview

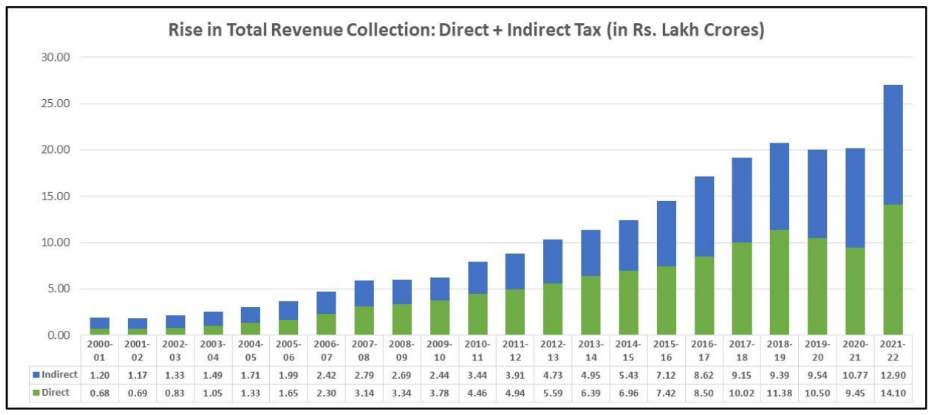

In the Financial Year (FY) 2022-23, there has been a notable upsurge of 30% in Gross Direct Tax collections, demonstrating a robust fiscal performance. Meanwhile, Net Direct Tax collections in FY 2022-23 have displayed a commendable growth of 23%, affirming a healthy financial trajectory. Advance Tax collections, as of September 17, 2022, have reached the substantial figure of Rs. 2,95,308 crore for FY 2022-23, reflecting a commendable 17% increase. Furthermore, the current fiscal year has witnessed the disbursement of refunds totalling Rs. 1,35,556 crore, marking an impressive 83% surge compared to the previous year. This surge in refunds showcases an efficient financial ecosystem and timely compliance.

Contribution from Listed Companies

Taxation in India involves the responsibility of individuals and businesses to fulfil their tax obligations in accordance with their earnings. The tax calculation process is influenced by various factors including expenses, tax categories, deductions, income levels, and exemptions. The application of tax rates is obligatory for entities regardless of their income levels. Does this imply that entities and individuals generating significant revenues are subject to substantial tax liabilities?

The top decile of tax contributors in India plays a vital role in bolstering the country’s tax revenues. This list includes a diverse range of entities, from established corporate giants to state-owned enterprises.

When contemplating prominent tax contributors in India, names of established corporate giants like Reliance, ITC, and Tata often come to mind.

Below is a compilation of the top ten most significant tax-paying entities in India:

| Sr No. | Company Name | Tax Contributuion (Rs. Cr) | Tax Rate (%) |

| 1 | Reliance Industries | 20,713 | 22% |

| 2 | State Bank of India | 17,649 | 25% |

| 3 | HDFC Bank | 15,350 | 25% |

| 4 | Tata Consultancy Services (TCS) | 14,604 | 26% |

| 5 | ICICI Bank | 11,793 | 26% |

| 6 | ONGC | 10,273 | 24% |

| 7 | Tata Steel | 10,160 | 56% |

| 8 | Coal India Limited | 9,876 | 26% |

| 9 | Infosys | 9,214 | 28% |

| 10 | Axis Bank | 7,703 | 42% |

All figures for FY2023

Here is a brief overview of some of the most common types of taxes that companies in India are required to pay:

- Corporate Income Tax: Companies are required to pay income tax on their profits earned during the financial year. The tax rate for companies with a turnover of up to Rs 400 crore in the financial year 2021-22 is 25%. For companies with a turnover exceeding Rs 400 crore, the tax rate is 30%.

- Minimum Alternate Tax (MAT): MAT is a tax imposed on companies that show a book profit but have not paid any tax due to exemptions, deductions, or incentives. The tax rate for MAT is 18.5%.

- Dividend Distribution Tax (DDT): Companies are required to pay DDT on the dividends they distribute to their shareholders. The tax rate for DDT is 15%, and it is deducted by the company before distributing the dividends.

- Goods and Services Tax (GST): GST is a consumption-based tax that is levied on the supply of goods and services. It is paid by the company while selling its products or services and is claimed as an input tax credit against the tax liability on the output.

- TDS: Tax Deducted at Source (TDS) is a tax that is deducted by the company while making certain payments such as salaries, rent, commission, etc. The amount of TDS is paid to the government and is credited to the recipient’s account.

- Custom Duty: Custom Duty is a tax levied on goods imported into India. The tax rate depends on the type of goods and the country of origin.

- Excise Duty: Excise Duty is a tax imposed on the production or manufacture of goods in India. The tax rate depends on the type of goods.

The government’s focus on improving tax compliance and streamlining the tax administration process has also contributed to the increase in tax revenue collections. This has led to a more efficient and equitable tax system, benefiting both taxpayers and the government.

The growth in tax collection over the past 9 years has been 10.12% CAGR clearly showing that India’s top taxpayers are worthy of recognition for their significant contributions to the country’s tax revenue collections. Their fiscal responsibility helps to fund essential government programs and services, such as infrastructure development, education, and healthcare.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.