In the dynamic world of finance, where information flows ceaselessly and markets evolve rapidly, investors seek innovative strategies that fuse the precision of quantitative analysis with the nuanced insights derived from fundamental analysis. This quest for a holistic approach has given rise to Quanta Mental Analysis, a potent blend that leverages the strengths of both quantitative and fundamental methodologies.

Decoding Quanta Mental Analysis:

Quantitative Precision:

Quanta Mental Analysis is an intricate dance between numbers and narratives. On one side of the spectrum, quantitative analysis delves into vast datasets with mathematical rigor. It employs cutting-edge algorithms and statistical models to extract patterns from historical price movements, trading volumes, and an array of financial ratios. This data-driven approach provides a level of precision that is often elusive to traditional analytical methods.

Fundamental Insights:

On the other hand, fundamental analysis adds the human touch to the quantitative symphony. It involves a deep dive into a company’s intrinsic worth by scrutinizing financial statements, assessing management acumen, and considering qualitative factors like industry trends and macroeconomic indicators. This holistic approach aims to understand the underlying story behind the numbers.

Data Synthesis:

The journey begins with the integration of diverse datasets. Financial metrics, market indicators, and economic variables are woven together to create a comprehensive tapestry. This amalgamation serves as the raw material for the construction of advanced mathematical models and algorithms.

Model Crafting:

The essence of Quanta Mental Analysis lies in the art of model crafting. Analysts meticulously design algorithms that can discern intricate patterns and correlations within the integrated datasets. These models, marrying quantitative metrics with fundamental indicators, provide a nuanced lens through which to view market complexities.

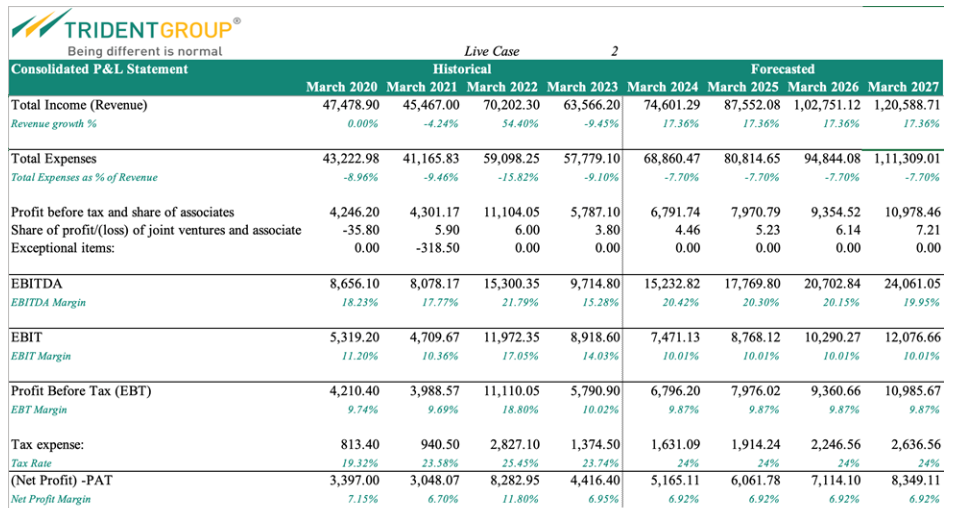

Here is an example where we have integrated data and models to forecast a company’s financials using Quanta Mental Analysis as an Economy-Industry-Company (EIC) regression forecast.

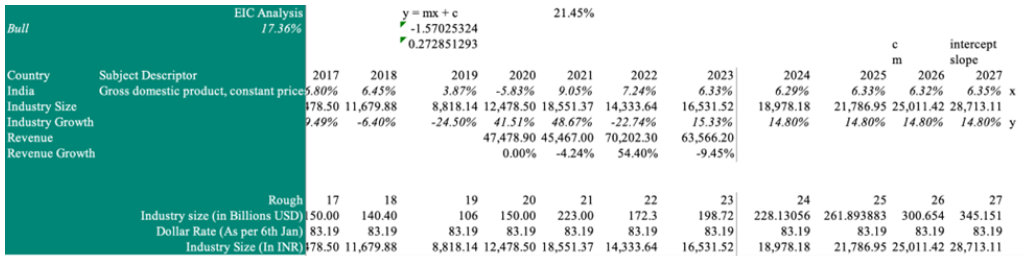

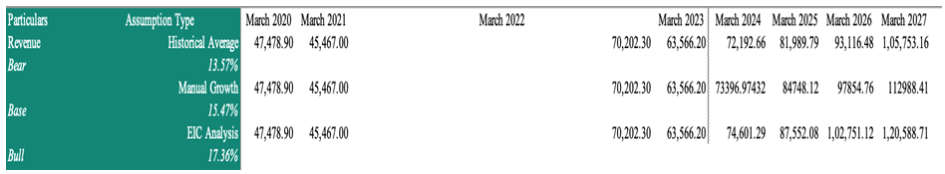

To begin with, we have used the global GDP growth rate and incorporated it with the industry growth rate (in terms of market size growth) of the textiles industry. This is done through a multi-variable regression forecast considering GDP growth rate, Industry Size, and Dollar Rate (to incorporate exports and imports in the industry).

Furthermore, this regression model is linked to the financials of a company (Trident here) to forecast its Revenues to build a model impacted by the business cycle. Generally, this type of Quanta Mental model is used for companies which are very sensitive to the business cycle.

This helps us construct scenarios which may impact the future financials and hence, the share price of the companies.

Future Horizons of Quanta Mental Analysis:

Looking ahead, the future prospects for Quanta Mental Analysis are brimming with possibilities, shaped by technological advancements and evolving market dynamics.

Technological Marvels:

As technology continues its relentless march forward, Quanta Mental Analysis stands poised to benefit. Artificial intelligence and machine learning, the vanguards of technological progress, are expected to further refine and amplify the capabilities of Quanta Mental Analysis tools.

ESG Integration:

The rising importance of environmental, social, and governance (ESG) considerations in investment decisions is likely to shape the future trajectory of Quanta Mental Analysis. Integrating ESG factors into both quantitative models and fundamental analysis aligns investment strategies with the growing emphasis on sustainable and responsible investing.

Risk Management Evolution:

Quanta Mental Analysis is set to play a pivotal role in shaping more robust risk management strategies. The ability to quantitatively assess risks, coupled with a deep understanding of fundamental risks, positions this approach as a key player in navigating the uncertainties inherent in financial markets.

In conclusion, the journey of Quanta Mental Analysis is a captivating exploration of the intersection between data and intuition. This hybrid approach not only adapts to the current financial landscape but also paints a compelling vision of the future. As technology evolves and market dynamics shift, Quanta Mental Analysis is poised to remain at the forefront of innovative investment strategies, offering a dynamic and influential role in shaping the future of finance.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions