Valued at a substantial USD 9.5 billion, the domestic diagnostic industry is poised for continued expansion, predicted to maintain a robust Compound Annual Growth Rate (CAGR) of approximately 11% over the next five years.

This remarkable growth can be attributed to multiple factors: an aging population’s heightened healthcare expenditures, rising income levels, growing awareness of preventive testing, advanced diagnostic test offerings, and the government’s strategic healthcare initiatives. While the Indian diagnostic market remains comparatively petite compared to developed nations, it is undoubtedly among the most rapidly advancing segments within the healthcare landscape.

Doctor referrals continue to constitute a significant portion of this business, often involving commissions paid to medical practitioners in return for diagnostic lab recommendations. Presently, disease diagnosis significantly outweighs wellness-focused diagnostics in the Indian scene.

Services

- Pathology Testing (In-Vitro Diagnosis): Pathology testing entails sample collection, often involving blood, urine, or stool, followed by precise analysis using advanced laboratory technology. This process yields invaluable clinical insights essential for effective disease treatment. Subfields encompass biochemistry, immunology, hematology, urine analysis, molecular diagnosis, and microbiology.

- Imaging Diagnosis (Radiology): Radiology encompasses imaging procedures like X-rays and ultrasounds, offering vital insights into a patient’s physiological or anatomical changes. Advanced techniques include CT scans, MRIs, and highly specialized PET-CT scans.

- Wellness and Preventive Diagnostics: These services aim to identify existing diseases or assess the risk of specific ailments before symptoms manifest. Wellness and preventive tests empower individuals to take proactive measures, potentially preventing chronic conditions through targeted screening and holistic health assessments.

Industry Players and Potential

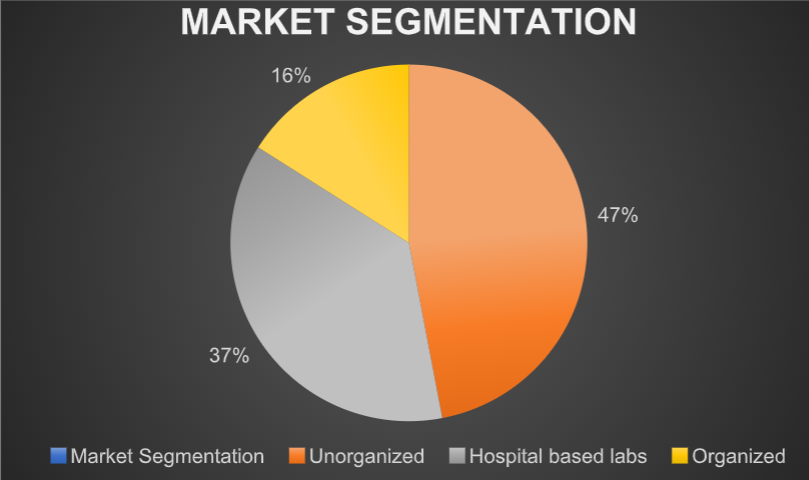

- Market Opportunity: Dr. Lal PathLabs (DLPL), Metropolis Healthcare (MHL), SRL Diagnostics (SRL), and Thyrocare Technologies (TTL) collectively control only ~6% of the market share, signifying a substantial scope for expansion and consolidation among national players.

Read: Metropolis Healthcare: A Pioneering Force in Diagnostics

- Growth Potential: Organized diagnostic providers with a national presence are poised for a 15-17% Compound Annual Growth Rate (CAGR) in the next five years. Their growth will be propelled by asset-light models and robust cash flows.

- Volume-Driven Growth: Intense competition and government regulations make volume the primary driver for the industry’s expansion. Players often engage in pricing battles to rapidly accumulate volume and ascend the cost curve, supported by private equity investors.

- Consumer-Centric Initiatives: Industry leaders are adapting to the evolving healthcare landscape by collaborating with retailers, offering home testing, and enhancing digital patient engagement, all while maintaining core testing services.

- Shift Towards Organization: The transition of unorganized businesses to organized players, anticipated industry consolidation, increasing preventive check-ups, and achieving significant scale, all favour large organized players with strong financial foundations.

Growth through the Asset Light Model

- Hub and Spoke Model: Organized diagnostic chains employ a hub and spoke business model, expanding their network by adding satellite labs and collection centres, often operating on a franchise basis. This approach enhances economies of scale and cost control, boosting competitiveness.

- Reagent Rental Model: Suppliers provide lab testing companies with equipment at minimal capital costs. Companies then commit to exclusively purchasing reagents from the supplier, paying periodic rentals. This rental model minimizes capital investment.

- Shop-in-Shop Model: Diagnostic providers enter outsourcing agreements with hospitals to manage their diagnostic operations, improving efficiency and streamlining processes.

- Home Collection Services: The convenience of home sample collection and testing, offered by both organized and unorganized players, contributes significantly to the success and urban market penetration of diagnostic chains. Phlebotomists collect and transport samples in specialized cold boxes to processing centres.

Industry Challenges

- Low Entry Barriers: The diagnostic sector’s historical growth rates, attractive to private equity investors, have led to increased competition. Low entry barriers have contributed to fragmentation.

- Regional Diversity: The vastness and cultural diversity of India pose challenges for expanding into new regions. Local players have the upper hand due to their knowledge of regional dynamics. Tapping Tier II, III, and IV cities is now a focus, with national players partnering with local providers for consolidation.

- Pricing Pressure: Intense competition between organized and unorganized players, with the latter holding 84% of the market, drives pricing pressure.

- Technological Vulnerability: The constant evolution of medical devices and analysers necessitates ongoing technological upgrades, imposing significant capital and maintenance costs. Smaller players, already constrained by funding, are especially affected.

Conclusion

India’s diagnostic industry, a thriving segment in the healthcare sector, hinges on economies of scale with cost-efficient sample processing. Established players are poised for sustained growth, boasting experience, brand trust, global standards, diverse test menus, and expansion capabilities. The potential for industry consolidation, robust financials, and shifting healthcare perspectives post-COVID-19 drive optimism, offering attractive long-term prospects for listed diagnostic giants like Dr. Lal, Metropolis, and Thyrocare. Increasing health insurance coverage and growing awareness of preventive healthcare further fuel their potential.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.