Are you dreaming of owning that swanky new car? It’s an exciting prospect, but how you decide to finance it can significantly impact your financial well-being. We’ll use a 5-year horizon, with market returns at an average of 12% and a car loan interest rate of 8.75%. Let’s break down the options and see which one suits you best.

Scenario 01: Directly Buying a Car on Loan

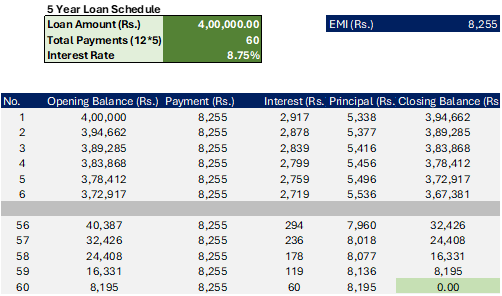

For simplicity, let’s assume your car costs Rs. 5,00,000, and you made a 20% down payment (Rs. 1,00,000), financing the remaining Rs. 4,00,000 with a 5-year loan at an 8.75% interest rate.

The monthly EMI for the next 5 years amounts to Rs. 8,255, but it’s important to note that this calculation does not account for the car’s depreciation, which typically ranges from 10% to 15% per year in this example.

In summary, at the end of the 5-year loan term, you’ll have full ownership of the car, even though its value may have depreciated by 60% during this period, not factoring in maintenance and fuel costs.

Scenario 02: Investing in SIP for Your Dream Car

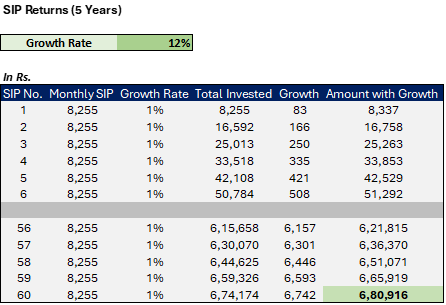

In this scenario, you decide to take the disciplined route of investing in SIP to accumulate funds for your dream car. With a 5-year horizon and a robust average market return of 12%, here’s how the numbers stack up:

If you can comfortably manage the Rs. 8,255 EMI, an alternative approach would be to consider investing in a SIP.

The total investment made through SIP would be approximately Rs. 4,95,300. After 5 years, your investment would potentially grow to a corpus of Rs. 6,80,000.

It’s essential to note that this is a conservative estimate, as market returns can sometimes exceed expectations, with the possibility of a +25% return in a given year. If you’re fortunate enough to experience higher returns in a year with a larger principal base, your investment could indeed yield even better results.

Scenario 03: Lump Sum Investment for Your Dream Car

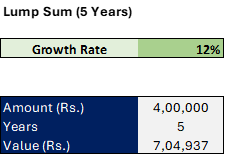

In this scenario, you have a substantial lump sum of money available to invest. Let’s see how this stacks up over a 5-year horizon with a 12% return rate:

In this case, your initial investment of Rs. 4,00,000 could potentially grow to Rs. 7,00,000 at the end of 5 years. Similarly, we can apply the same principle as in the SIP scenario, where the market may provide exceptionally high returns in any given year, further enhancing your investment’s growth.

By delaying your car purchase for 5 years and strategically investing your money now, you can potentially afford an even better car in the future. It’s generally recommended not to take a loan for a depreciating asset, so it’s crucial to make your decision wisely and plan for a financially secure future.

Know more: