Earnings Per Share, commonly referred to as EPS, is not merely a number on a financial statement; it is the lifeblood of any stock, a reflection of a company’s financial prowess, and a key determinant of investor sentiment. EPS expansion, when a company’s earnings per share shows remarkable growth, can be a harbinger of great things to come. In this article, we delve into the captivating stories of five stocks that defied the odds, surging to new heights, all thanks to the powerful magic of EPS expansion.

Earnings Per Share (EPS)

A fundamental financial metric that calculates the portion of a company’s profit allocated to each outstanding share of common stock, usually measured in Rs. It is a crucial indicator of a company’s financial performance and profitability.

To illustrate this concept, let’s consider a straightforward example. Imagine Company XYZ, which reported a net income of Rs. 1,000,000 in the last fiscal year. Additionally, the company has 1,00,000 shares of common stock outstanding.

To calculate its EPS, you simply divide the net income by the number of shares:

EPS = Net Income / Number of Shares

EPS = Rs. 1,000,000 / 1,00,000

EPS = Rs. 10

This means that for every share of Company XYZ, the company earned Rs. 10 in profit. Now, let’s explore how EPS expansion can influence stock prices with real-life examples.

If a company you own shares in makes more money (EPS goes up), other people see it as a good investment, and they want to buy that company’s stock. When more people want to buy it, the stock’s price goes up. For example, if your shares had earnings of Rs. 10, and that goes up to Rs. 20, more people will want to buy your shares, making them more valuable.

Let’s examine recent examples that have spurred stock prices through substantial EPS growth in recent quarters. It’s important to note that, as a disclaimer, some of these stocks have also experienced an expansion in their Price-to-Earnings (PE) ratios.

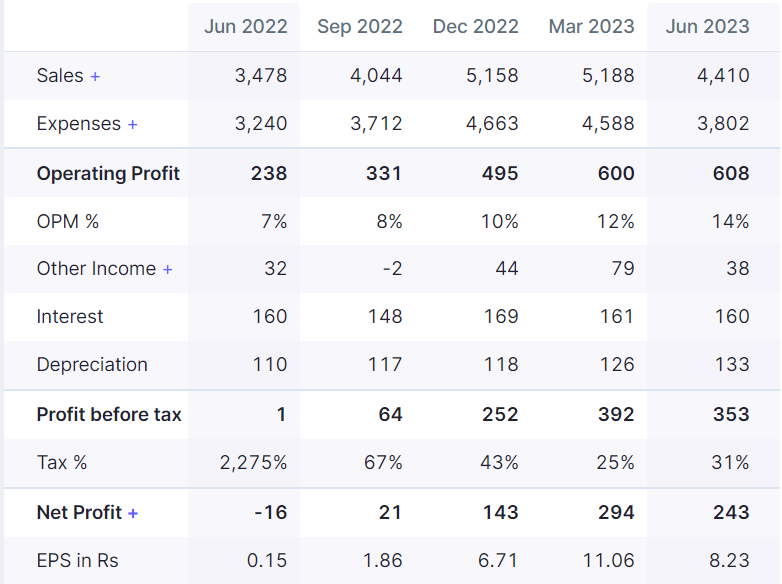

Jindal Saw

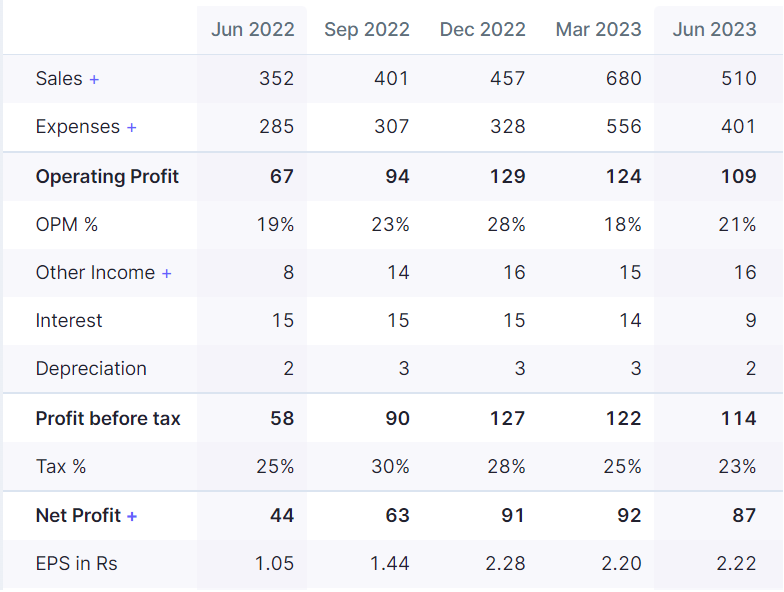

SJS Enterprises

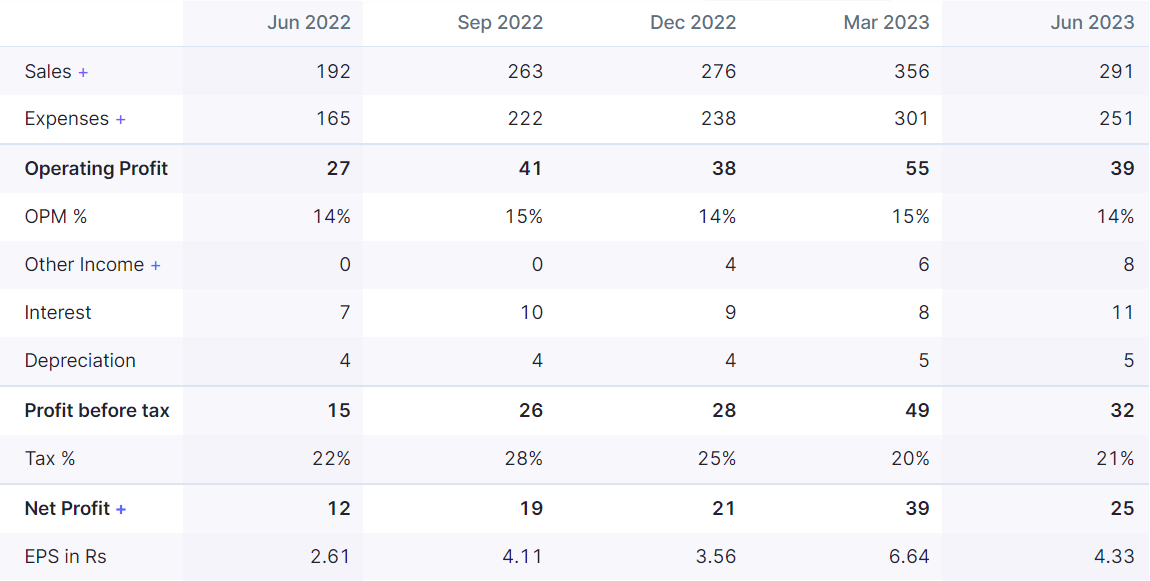

Man Infra

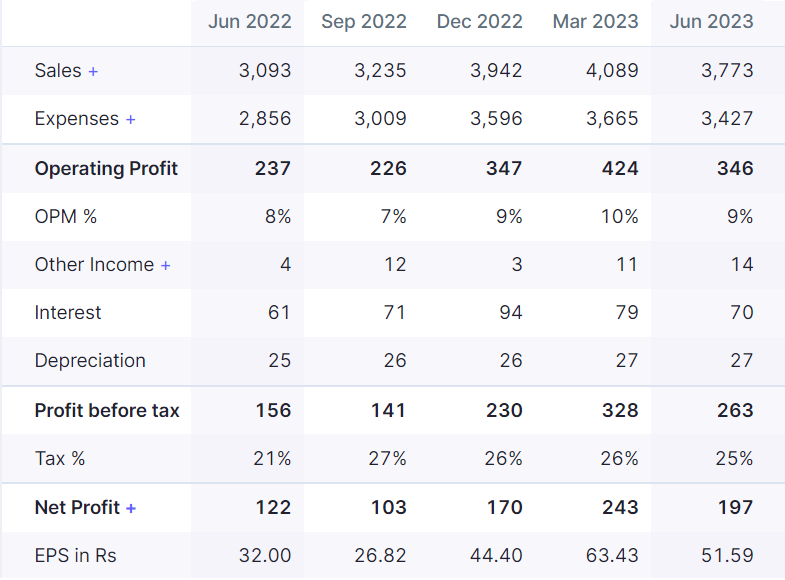

Kaynes Technology India

Apar Industries

In conclusion, the evident correlation between EPS and Stock Price underscores the pivotal role that earnings per share plays in the valuation of a stock. Even in cases where the Price-to-Earnings (PE) ratio remains stagnant, indicative of the market’s initial oversight, robust EPS growth alone can propel the stock price to new heights.

However, the most favourable scenario for any stock unfolds when the market recognizes the company’s potential, prompting an increase in the PE ratio alongside EPS expansion. In this synergy of EPS and PE, we find a powerful formula for stock market success, as these two key factors intertwine to drive stock prices to their zenith, demonstrating that while PE may measure the present, EPS shapes the future in the realm of stock investments.

Disclaimer:This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.