Despite the glory on the football field, the country faces an economic crisis of staggering proportions in 2023. The euphoria from Messi’s brace in the thrilling 120-minute encounter that ultimately led to victory has given way to the harsh reality of a nation grappling with unprecedented challenges.

The economic woes are stark, with inflation rates skyrocketing to an alarming 143%, casting a pervasive shadow over Argentina. This surge in inflation has had dire consequences, pushing millions of citizens into poverty and creating a socio-economic landscape fraught with uncertainty. The nation, once basking in the afterglow of World Cup success, now finds itself navigating through a complex and tumultuous period. The ramifications of the economic crisis have set the stage for a pivotal presidential election.

A Nation in Turmoil: Inflation’s Stranglehold

Argentina’s economic challenges are deep-rooted, marked by decades of struggle, including three recent sovereign debt defaults.

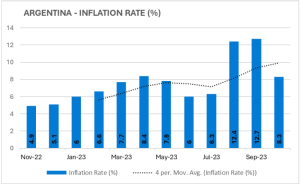

Inflation Rate MoM (Argentina)

Data source: Trading Economics

The current inflation surge, reaching an alarming 143%, has plunged a significant portion of the population into poverty, setting the stage for a tense presidential election.

Javier Milei: The Maverick Shaking Up Argentine Politics

In the midst of economic turmoil, a political outsider, Javier Milei, has emerged as a formidable force. The self-proclaimed “anarcho-capitalist” has captured the attention of those disillusioned with the status quo, offering radical economic reforms as a solution to Argentina’s woes.

Dollarization Dreams: Milei’s Risky Gambit

Milei’s proposed solution to Argentina’s economic woes involves a radical shift – the dollarization of the economy. By abandoning the peso and adopting the US dollar, Milei believes he can rein in inflation.

However, the risks associated with this move, including loss of monetary sovereignty and economic instability, cannot be ignored.

Debating Dollarization: Pros and Cons

The notion of dollarizing Argentina’s economy sparks a fierce debate among economists. Supporters argue for stability, increased investor confidence, and economic growth. Opponents, on the other hand, express concerns about potential downsides, such as loss of control over monetary policy and negative impacts on the export sector.

Know: All you Need to Know about Inflation

The Election Showdown: Massa vs. Milei

As Argentina heads to the polls, the choice between Sergio Massa, a representative of the status quo, and the radical economic reformer, Javier Milei, is laden with significance. Massa’s predictable approach contrasts sharply with Milei’s disruptive proposals, making this election a pivotal moment for Argentina’s economic future.

Dollarization Decisions: Countries that Embraced Stability in Crisis

- Ecuador: Dollarized in the year 2000 after facing a severe banking and economic crisis.

- El Salvador: Adopted the US dollar in 2001 to stabilize its economy after experiencing a civil war and economic turmoil.

- Panama: Although not a result of a crisis, Panama has used the US dollar as its official currency since its independence in 1903.

- Zimbabwe: Faced with hyperinflation, Zimbabwe began unofficial dollarization by allowing the use of foreign currencies, including the US dollar, in 2009.

- Kosovo: After gaining independence in 2008, Kosovo adopted the euro as its official currency to promote stability.

- Montenegro: Similar to Kosovo, Montenegro unilaterally adopted the euro in 2002, without a formal agreement with the Eurozone.

- Timor-Leste: Following its independence in 2002, Timor-Leste adopted the US dollar to foster economic stability.

Economic Destiny in the Balance

Argentina’s economic future hangs in the balance as citizens prepare to cast their votes. Whether they choose the familiar path or opt for radical change, the outcome of this election will undoubtedly shape the nation’s trajectory for years to come.